credit history examiner

the credit score checker allows you to estimate your credit score declaration and you may cibil score. its a good three-little finger numeric term one is short for your own creditworthiness.

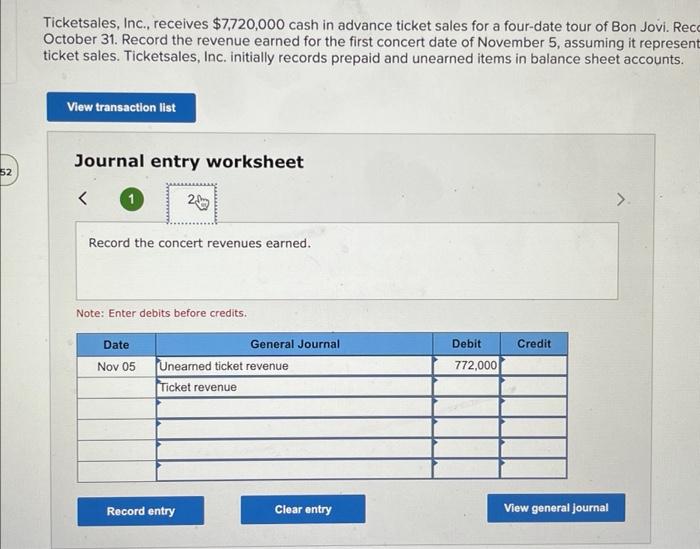

if you’re planning to help you request credit cards, it is needed to possess the cibil score end up being within minimum 750. evaluating the history from borrowing of applicant is a vital a portion of the evaluation processes.

a credit rating is an analytical symbolization of the creditworthiness. it can help when you look at the contrasting your capability to blow straight back the total amount you’ve got borrowed. someone’s credit score usually ranges regarding 300-900, and also the that towards higher rating is considered to be a trustworthy candidate. constantly you will need to reach the higher inside range as it gets very helpful during the time of trying to get that loan otherwise credit cards. while, when you yourself have a minimal get or you fall-in down assortment which displays youre a reckless mortgage applicant as well as have not made punctual money of financing/expenses.

this is the reduced CIBIL get variety. they shows that you really have put off your bank card bill costs otherwise loan EMIs and you’re at the a leading-danger of turning into an excellent defaulter.

even though this CIBIL get variety is recognized as reasonable, it signifies that you have been not able to spend the money for dues timely.

that it CIBIL rating means that you have a good credit score conduct. you’ve got a high danger of providing credit cards or financing recognition. not, you may still maybe not have the best interest if you are obtaining a loan.

CIBIL get over 750 is known as expert and you will means that your provides continuously repaid the dues punctually and possess a superb fee record. since you are on reduced risk of turning into a great defaulter, lenders will provide you with finance with ease and also at all the way down interest rates.

- personal information

- credit score length

- brand new credit

- quantity due

- borrowing merge

just why is it crucial that you look after good credit?

enhances the qualifications to have money: good credit enhances their qualification to locate a loan shorter. a good credit score means that you pay the costs or outstanding number fast you to definitely makes a beneficial impact you have with the financial institutions or other loan providers where you possess taken out that loan.

less mortgage approvals: people with a good credit score and you will enough time credit history try offered pre-accepted loans. additionally, the loan you have removed becomes recognized easily and you may handling date was zero.

lower interest: with a decent credit score, you may enjoy the benefit of a lower interest rate to the amount borrowed that you have removed.

playing cards https://paydayloanalabama.com/hueytown/ which have attractive experts- youre provided credit cards that have attractive gurus and you can benefits if the you really have a healthier credit rating.

large charge card limitations: a good credit score besides gets the finest out of handmade cards which have attractive professionals or all the way down interest into the loan you have taken out as well as you are eligible so you can get a higher loan amount. a good credit score means youre able to handle the credit throughout the greatest trend, thus, financial institutions otherwise financial institutions usually envision providing you credit cards with a high restriction.

which are the factors which can be felt getting figuring credit rating?

credit score record: credit rating portrays the capacity of your financing applicant if or not he/she’s responsible for paying the debts or not. this has the information of your level of account you keep, borrowing incorporate information and you can factual statements about postponed or failed costs.

credit rating inquiries: borrowing inquiries through the advice including the form of mortgage which provides inquired about, the degree of loan you really have taken out and you can whether your are just one candidate or a combined candidate.

just how is the credit rating calculated?

a credit rating is actually calculated in another way because of the individuals credit advice bureaus. standard items on such basis as which your credit rating was determined try stated lower than:

fee background – 35% of your credit rating is actually determined based on their payment record. your own commission background suggests just how prompt you’ve made the fresh costs, how many times you skipped to your costs or exactly how many days past the latest due date you paid down your bills. to help you rating highest if you have increased ratio out-of towards-go out payments. be sure to never ever overlook costs since this would get-off an awful impact on the rating.

simply how much you owe – in the 30% of the credit score is determined by how much cash you borrowed towards the money and you can credit cards. when you yourself have a leading equilibrium and just have reached the fresh maximum of the credit card then this should lead to a drop in your credit rating. when you find yourself short balance and punctual repayments do assist in improving the get.

credit history length – along your credit score are guilty of 15% of your own credit score. in case your reputation for to your-big date repayments are long next naturally you might has increased credit history. in contrast, will eventually, you ought to submit an application for a charge card otherwise mortgage rather than to avoid it and that means you also have a credit history for banks’ review.

just how many products you’ve got – the items (types of money) that you have is in charge of the fresh ten% of the credit history. having a variety of individuals items like fees loans, mortgage brokers, and you will playing cards assist in boosting your credit history.

borrowing from the bank pastime – remaining 10% relies on your own present credit factors. borrowing pastime has everything from beginning or obtaining various levels, cost history, style of money you have got applied for and credit limit use.

what exactly is a good credit score?

a credit rating is actually an indication out-of creditworthiness which is usually 3-finger numeric. they range regarding 300 so you’re able to 900 and certainly will be easily calculated playing with a credit score checker. a credit rating regarding 680 otherwise significantly more than is recognized as being an effective score. lenders rely on the financing get just before giving that loan. of course, if a person is applicable for a loan, lenders have a look at –

- CIBIL statement and you can rating

- a job updates

- security passwords

if for example the borrower otherwise debtor is not able to pay back the debt because of any handicap or an extended-identity criticism, the financing medical insurance protects the brand new debtor.

as to why it is essential to care for good credit?

a credit score indicates the newest creditworthiness of individuals. it certainly is a good step three-digit numeric that selections off 3 hundred so you’re able to 900.